21 December, 2021 Financial & Technical

Goods and Services Tax (GST) was introduced by the Indian Government on the procurement of goods or services in the year 2017.

Goods and Services Tax (GST) was introduced by the Indian Government on the procurement of goods or services in the year 2017. GST has replaced all the other indirect taxes, like Value Added Tax (VAT), and compressed them into a single tax. GST is charged by the government in slabs. The present slabs being 5%, 12%, 18%, and 28%.

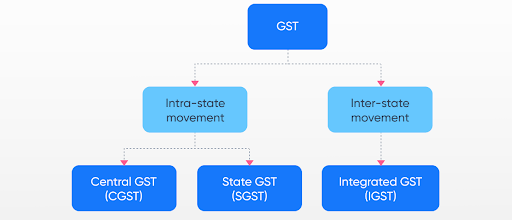

GST is levied on all types of goods and services except petroleum products, alcoholic drinks, and electricity. It is a destination-based tax. GST is collected by the state in which the said good or service is consumed rather than to that state in which the good or service was manufactured. This can be simplified as below:-

Department of Revenue has noticed that many dishonest persons are availing or passing on Input Tax Credit (ITC) fraudulently by generating fake invoices.

Last year, (DoR) detected in data analytics that many Permanent Account Numbers (PAN) showing turnover of crores of rupees in Goods and Services (GST) returns but not paying a single rupee in income tax.

Accordingly, DoR made changes for auto population of GST turnover in Form 26AS just for the information of the taxpayer at no extra cost. The DoR also acknowledged that there might be some differences in GSTR-3Bs filed and the GST shown in the Form 26AS. But it cannot happen that a person shows a turnover in crores in GST and does not pay a single rupee of income tax.

It can be seen as an important step in the direction of “Transparent Taxation – Honoring the Honest”. The auto-population of information on GST turnover in Form 26AS would force dishonest taxpayers who are under-reporting their turnover in the ITRs. This will consequently force them to pays the correct income tax.

With this move, the suspected fake invoice generators are being identified for serious action under GST and other laws including suspension of their GST registration based on the fact that whether their income tax payment commensurate with the expected profit margin on turnover reported by them in the GST returns.

It is worthwhile to mention that Govt. kitty for collection of tax is increasing through GST. In November 21, GST collection has topped the charts since the implementation of GST. The GST revenue (gross) collected in the month of Nov 2021 is INR 1,31,526 crore and dividing it has CGST at INR 23,978 crore, SGST at INR 31,127 crore, IGST at INR 66,815 crore with INR 32,165 crore collected on import of goods) and Cess at INR 9,606 crore (including INR 653 crore collected on import of goods).